How Animals Danger Protection (LRP) Insurance Coverage Can Secure Your Livestock Financial Investment

Animals Threat Security (LRP) insurance policy stands as a reputable guard versus the uncertain nature of the market, supplying a calculated method to securing your possessions. By delving right into the ins and outs of LRP insurance policy and its diverse advantages, livestock manufacturers can strengthen their financial investments with a layer of protection that goes beyond market variations.

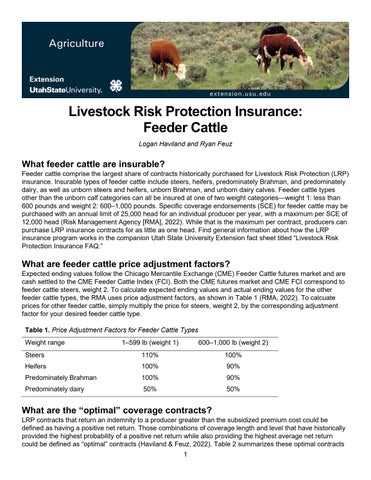

Comprehending Livestock Danger Defense (LRP) Insurance

Recognizing Animals Risk Protection (LRP) Insurance coverage is crucial for animals manufacturers aiming to alleviate financial dangers connected with cost changes. LRP is a federally subsidized insurance policy item designed to safeguard manufacturers versus a decrease in market costs. By providing coverage for market value declines, LRP helps manufacturers secure a floor price for their animals, ensuring a minimal degree of earnings regardless of market variations.

One secret element of LRP is its versatility, allowing manufacturers to customize insurance coverage degrees and policy lengths to suit their specific requirements. Manufacturers can choose the number of head, weight array, coverage cost, and coverage duration that line up with their manufacturing goals and run the risk of resistance. Comprehending these adjustable alternatives is crucial for manufacturers to properly manage their rate danger direct exposure.

Moreover, LRP is readily available for numerous animals types, consisting of cattle, swine, and lamb, making it a functional danger management tool for livestock manufacturers across different markets. Bagley Risk Management. By familiarizing themselves with the details of LRP, producers can make enlightened choices to guard their investments and make sure monetary stability when faced with market uncertainties

Advantages of LRP Insurance Coverage for Animals Producers

Livestock manufacturers leveraging Livestock Risk Protection (LRP) Insurance policy acquire a tactical advantage in securing their investments from rate volatility and securing a secure monetary ground amidst market uncertainties. One crucial advantage of LRP Insurance coverage is rate protection. By setting a floor on the price of their livestock, manufacturers can reduce the danger of considerable financial losses in the event of market slumps. This allows them to prepare their spending plans better and make educated choices about their operations without the continuous worry of rate changes.

Additionally, LRP Insurance policy gives producers with peace of mind. Generally, the advantages of LRP Insurance coverage for livestock producers are substantial, providing a useful tool for taking care of danger and ensuring monetary security in an uncertain market environment.

How LRP Insurance Coverage Mitigates Market Risks

Alleviating market dangers, Animals Risk Security (LRP) Insurance policy provides livestock manufacturers with a trustworthy shield against rate volatility and monetary uncertainties. By using protection against unanticipated cost decreases, LRP Insurance coverage helps manufacturers safeguard their financial investments and maintain financial stability despite market fluctuations. This kind of insurance permits livestock manufacturers to secure a price for their animals at the beginning of the policy period, ensuring a minimum rate degree no matter of market changes.

Actions to Secure Your Livestock Financial Investment With LRP

In the realm of farming danger administration, implementing Animals Danger Security (LRP) Insurance policy involves a tactical procedure to guard investments against market variations and unpredictabilities. To secure your livestock financial investment successfully with LRP, the very first step is to examine the certain risks your procedure faces, such as price volatility or unforeseen weather condition occasions. Recognizing these risks permits you to figure out the insurance coverage level required to safeguard your financial investment appropriately. Next, it is essential to study and pick a respectable insurance company that uses LRP policies customized to your livestock and service requirements. Once you have actually picked a company, very carefully review the policy terms, conditions, and coverage limits to guarantee they line up with your risk management objectives. Furthermore, routinely keeping track of market patterns and adjusting your protection as Visit Website required can assist optimize your defense against possible losses. By following these actions faithfully, you can boost the protection of your animals financial investment and browse market unpredictabilities with confidence.

Long-Term Financial Security With LRP Insurance

Making sure withstanding economic security through the utilization of Animals Threat Defense (LRP) Insurance coverage is a sensible long-lasting method for farming producers. By incorporating LRP Insurance coverage right into their risk monitoring plans, farmers can protect their animals financial investments versus unanticipated market variations and adverse occasions that can jeopardize their financial health with time.

One key benefit of LRP Insurance policy for long-lasting economic safety is the comfort it offers. With a reputable insurance coverage in position, farmers can reduce the economic risks related to volatile market problems and unexpected losses due to elements such as condition outbreaks or all-natural calamities - Bagley Risk Management. This security allows manufacturers to concentrate on the day-to-day procedures of their livestock business without constant stress over possible economic troubles

Additionally, LRP Insurance policy provides a structured strategy to handling threat over the long-term. By establishing particular coverage degrees and choosing appropriate recommendation periods, farmers can tailor their insurance policy plans to align with their monetary objectives and run the risk of tolerance, making sure a protected and sustainable future for their animals procedures. To conclude, investing in LRP Insurance is a proactive approach for farming manufacturers to attain enduring economic safety and protect their incomes.

Verdict

In verdict, Animals Danger Defense (LRP) Insurance policy is a valuable device for animals manufacturers to reduce market threats and secure their financial investments. By comprehending the advantages of LRP insurance coverage and taking actions to implement it, manufacturers can accomplish long-term monetary security for their procedures. LRP insurance policy supplies a safety and security internet versus cost changes and makes certain a level of stability in an unforeseeable market setting. It is a wise option for safeguarding livestock financial investments.